how to get uber eats tax summary

Additional Tax Resources for Uber Drivers. Know what taxes you have to pay.

Uber Tax Filing Information I Drive With Uber Filing Taxes Uber Uber Driver

Ad Easily File Your Rideshare and Delivery Driver Taxes With TurboTax Self-Employed.

. How To File Uber Tax Return Canada. Create an accountYou need to create a tax profile after your initial one has been. In the pay statement we are able to see Trip Earnings Fare Uber Fee.

Find out how to set up your bank. When you deliver with the Uber Eats app your earnings are transferred automatically so you dont have to worry about paperwork. Ill show you where to find your tax summary form for Uber Driver taxes 2021.

To further assist you with the Uber. Your total earnings gross. Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process.

In addition you should be able to. The Uber tax summary isnt an official tax document. We will provide you with a 1099-K if you earned more than 20000 from on-trip transactions your trip transaction amounts before Uber.

Consult with your tax professional regarding potential deductions. I cannot give you Uber Driver tax advice Im simply showing you wh. Every driver and delivery person on the Uber app will receive a tax summary.

What happens if you. Sign In Email or mobile number. Uber Eats Income.

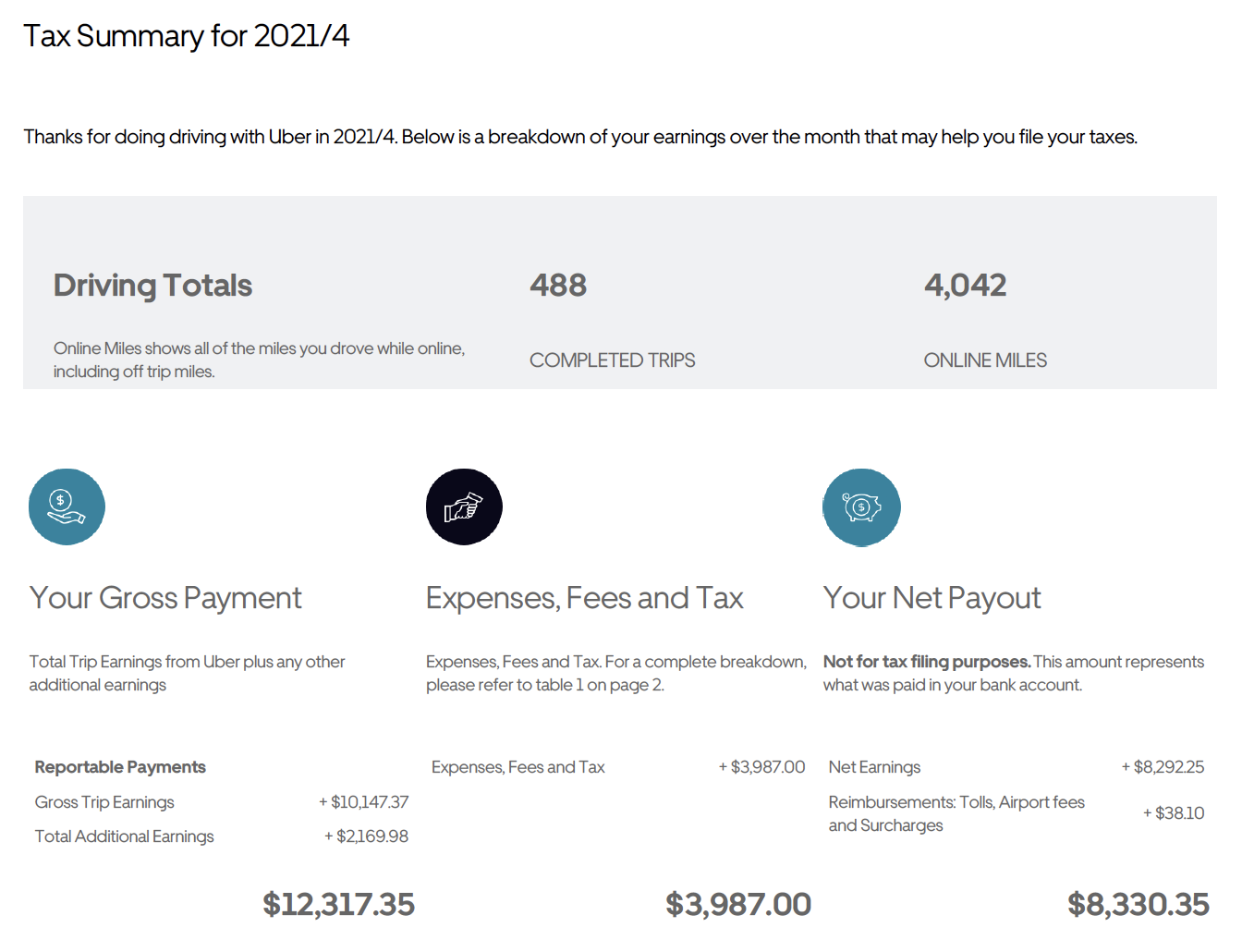

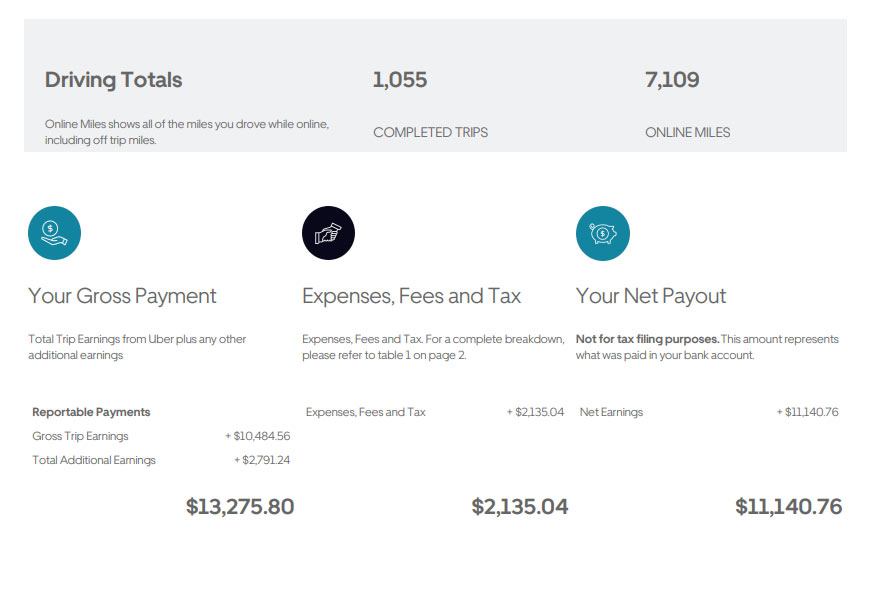

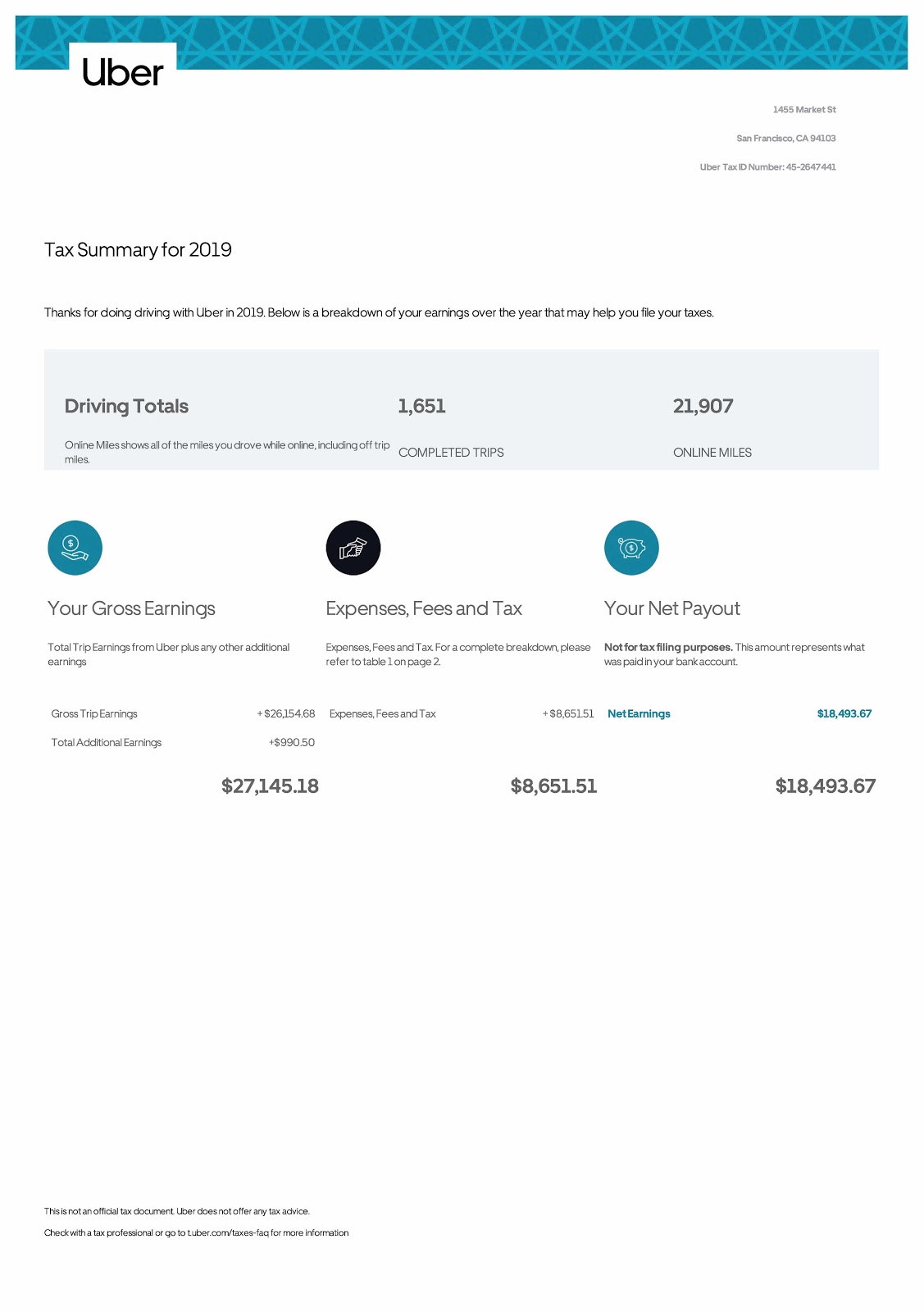

If you log into your Uber driver account you can go to Tax Documents and then find your tax summary. The uber service fee was 1531. Im having a bit of a problem determining how to read the monthly tax summaries properly.

Ad Easily File Your Rideshare and Delivery Driver Taxes With TurboTax Self-Employed. Your Tax Summary document includes helpful information such as. If you met the earnings thresholds to receive 1099s they should be.

To review your Uber expenses. Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Youll report income through the standard tax return Form 1040.

It doesnt matter that you didnt get a 1099-K form. I am an Uber Eats driver and I have query regarding the income declaration on the ATO app. Youll use Schedule C to list your income and expenses and expenses write-offs.

In Sept it says my gross was 5101. Uber Eats and the Annual Tax Summary In my opinion the annual summary is the most important of the three documents you can download from the Tax Information tab in your. Click on Tax Summary Select the relevant statement.

Dont have an account. Use the Uber Tax Summary to enter your income. Review the expenses in your Uber Tax Summary.

Prepare a self-employed income tax return steps 1. Except I shouldnt call it a tax summary because its not an official tax. Certain Uber expenses need to be combined and entered as a single amount in TurboTax.

Plus there may be additional state and. Uber will file IRS Form 1099-MISC andor 1099-K with the IRS and your state tax agency if you were paid over 600 during the. If you are self-employed complete a Self-Assessment Tax Return and have access to HMRCs online services then you can get your Tax Summary online.

Hopefully we have covered all of the questions you may have about the Uber tax filing process. Will I get a 1099 from Uber Eats. Here are the essentials.

If you have elected to receive.

Instaccountant How To Read Uber Tax Summary 2019 Explained Facebook

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Eats Order Summary Explained

Tax Return Online English Ys Accounting

2017 Uber Tax Solutions Thread Uber Turbotax Workshop Page 2 Uber Drivers Forum

March 2018 Tax Summary Uber Drivers Forum

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Uber Bas Explained The Ultimate Guide To Bas S For Uber Rideshare

Documentos Fiscales Para Socios De La App

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Your Annual Tax Summary Should Be Available On July 7 Uber Drivers Forum

How To Understand Uber Eats 1099s When They Lie About Your Pay

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier